Expense Categories¶

Expensed organizes expenses into categories to help with reporting, budgeting, and accounting. Here's what each category means.

Standard Categories¶

| Category | Icon | What It Includes |

|---|---|---|

| Fuel/Gas | Gas pump | Gas station purchases, fuel for company vehicles |

| Meals & Entertainment | Fork & knife | Business lunches, client dinners, team meals |

| Lodging/Hotels | Bed | Hotel rooms, Airbnb, accommodation during travel |

| Airfare | Airplane | Flights, airline fees, seat upgrades |

| Ground Transportation | Car | Uber, Lyft, taxis, rental cars, parking, tolls |

| Office Supplies | Printer | Pens, paper, desk accessories, small equipment |

| Software/Subscriptions | App icon | Software licenses, SaaS subscriptions, apps |

| Miscellaneous | Dots | Anything that doesn't fit other categories |

Category Details¶

Fuel/Gas ¶

Use this for vehicle fuel purchases:

- Gas station fill-ups

- Diesel fuel

- Electric vehicle charging

Mileage vs. Fuel

If you're tracking mileage for reimbursement, don't also expense fuel. The IRS mileage rate includes fuel costs. Use either mileage tracking OR fuel receipts, not both.

Meals & Entertainment ¶

Use this for business-related meals:

- Client lunches and dinners

- Team meals during work travel

- Coffee meetings with vendors

- Working lunches

Include Business Purpose

For meals, always note who you met with and the business purpose. Example: "Lunch with ABC Corp to discuss Q2 contract renewal"

Lodging/Hotels ¶

Use this for overnight accommodations:

- Hotel rooms

- Airbnb and vacation rentals

- Extended stay hotels

- Resort fees and taxes

Multi-Night Stays

For multi-night hotel stays, you can submit one expense with the total amount and attach all receipts.

Airfare ¶

Use this for air travel:

- Flight tickets

- Baggage fees

- Seat selection fees

- In-flight WiFi

- Airline club memberships (if approved)

Ground Transportation ¶

Use this for surface travel:

- Uber and Lyft rides

- Taxi fares

- Rental cars

- Parking fees

- Toll charges

- Train and bus tickets

Mileage Alternative

If you use your personal car, consider using Mileage Tracking instead of ground transportation expenses.

Office Supplies ¶

Use this for work supplies and small equipment:

- Pens, paper, notebooks

- Printer ink and toner

- Desk accessories

- Small equipment (under $100)

- Postage and shipping

Software/Subscriptions ¶

Use this for digital tools:

- Software licenses

- Monthly SaaS subscriptions

- Mobile apps

- Online services

- Domain registrations

Check with Admin

Some organizations have pre-approved software lists. Check with your admin before purchasing new software.

Miscellaneous ¶

Use this for expenses that don't fit other categories:

- One-time purchases

- Unusual business expenses

- Items pending categorization

Avoid Miscellaneous When Possible

Try to use a specific category when you can. Miscellaneous expenses may require additional explanation during approval.

Category Limits¶

Your organization may set spending limits per category:

| Category | Daily Limit | Per-Item Limit |

|---|---|---|

| Meals | $75 | $150 |

| Lodging | $250 | $500 |

| Fuel | $100 | $75/gallon |

Limits vary by organization. Check with your admin for your company's specific policies.

Selecting the Right Category¶

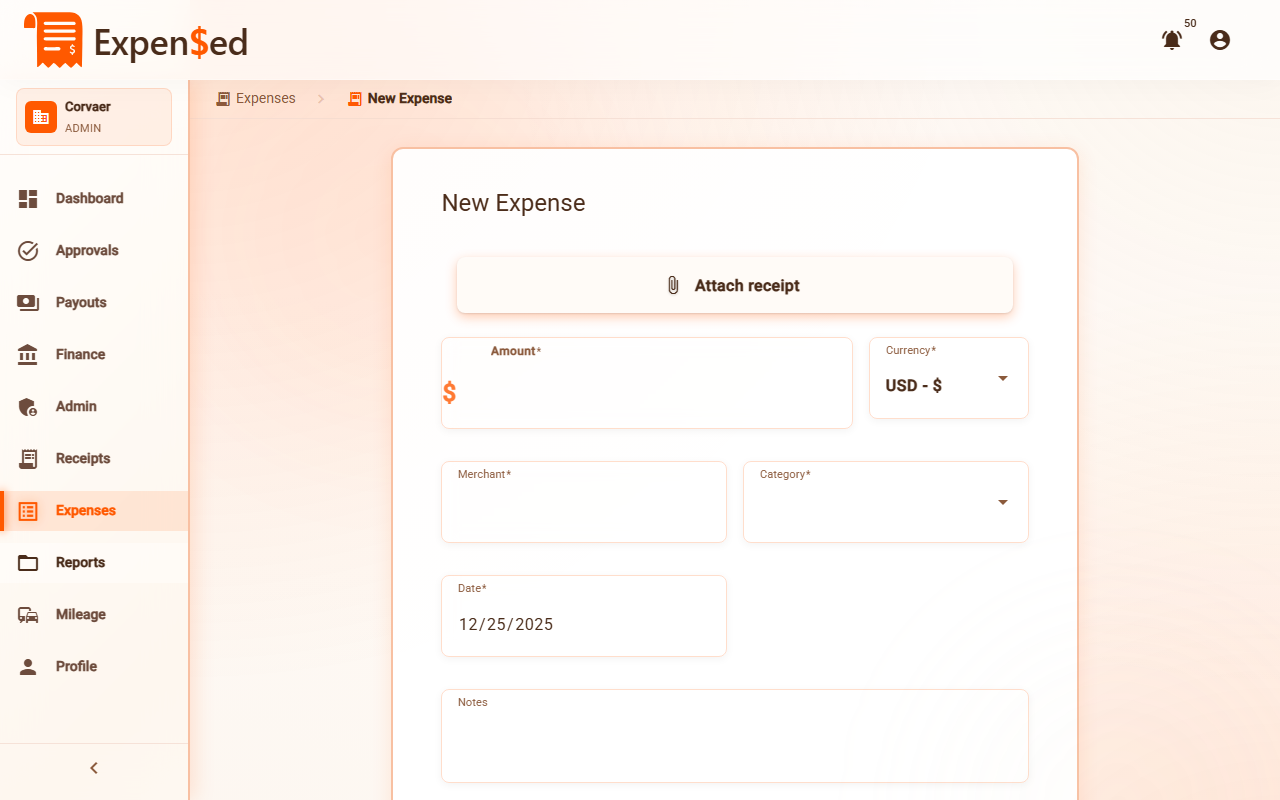

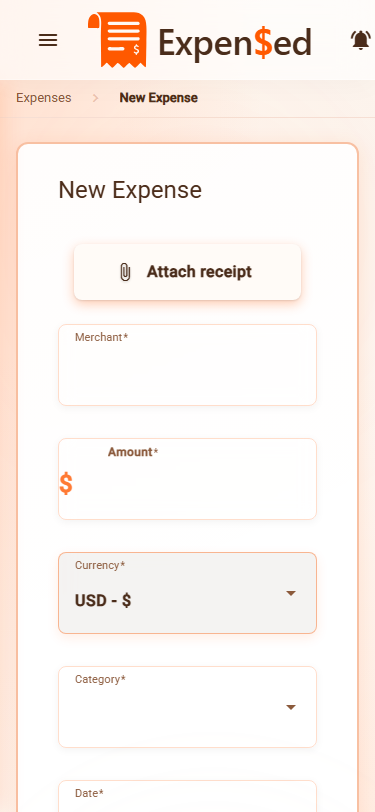

When creating an expense:

- Click the Category dropdown

- Browse categories by icon and name

- Select the most appropriate category

- If unsure, ask your manager or use Miscellaneous

Category Filters¶

You can filter your expense list by category:

- Go to Expenses

- Click the Category filter

- Select one or more categories

- The list shows only matching expenses

Next: Viewing Expenses →